Long-Term Focus

During a bear market it can be difficult to focus on the long-term benefits of staying invested. No one likes to see their assets go down in value. There is an inverse relationship between money and our emotions in that the lower the values the higher our anxiety. Behavioral research has long shown that we dislike losses twice as much as we like gains. It can be especially hard during times of economic hardship when the media headlines are extremely gloomy. I therefore thought it would be helpful during this market drawdown to extol the benefits of having a long-term investment focus.

- Long-term investing allows for the power of compound interest to work in your favor. The longer you invest, the more time your money has to grow, which can lead to significantly larger returns over time. Compound interest allows investments to grow at in increasing rate by harnessing the power of time. The longer investments are left to compound, the greater the potential returns. Because compound interest is calculated on the principal plus any accumulated interest, it has the potential to generate higher returns than simple interest that is based only on the original principal. Compound interest allows investments to generate income without the need for ongoing effort. This can be a useful source of passive income, especially in retirement.

- A long-term investment horizon can help you weather market fluctuations such as the one we are currently experiencing. Short-term market can be volatile and unpredictable, but over the long-term, the stock market has historically trended upwards. By taking a long-term perspective, you are more likely to ride out any short-term market volatility.

- Long-term investing can help you achieve your financial goals. Whether you are in retirement or saving for retirement, a down payment on a home, or your child’s education, a long-term investment focus can help you to reach your goals more effectively.

Overall, a long-term investment focus can help you maximize your investment returns and achieve your goals in a more effective manner.

Model Portfolio Performance and Positioning

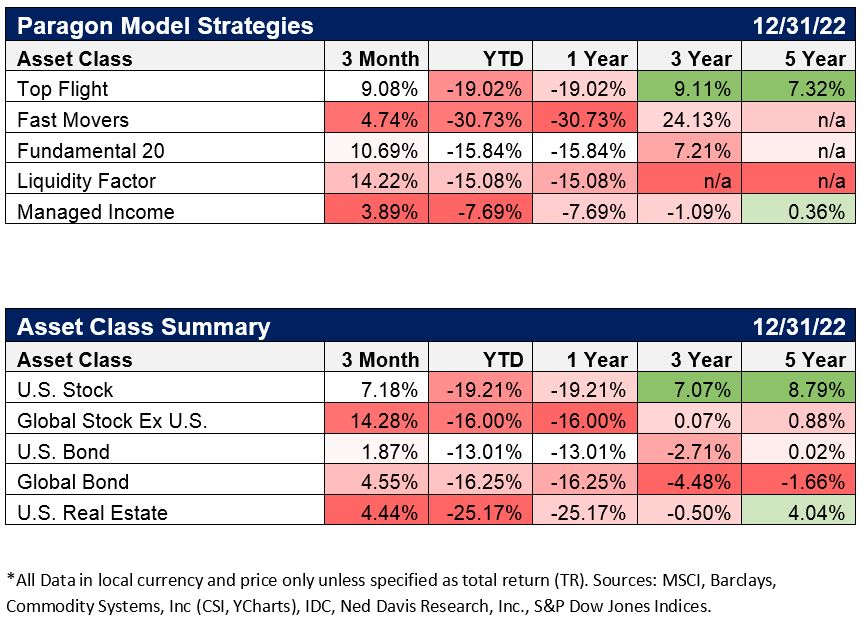

Most of our strategies outperformed relevant benchmarks for the quarter and the year. If the economy heads into a recession than we probably haven’t seen the lows in the market. If we do move significantly lower from here, we will then look to position our holdings to the more aggressive side. For the time being we will keep our normal positioning and let our allocations and rebalancing keep us in the game.

The Managed Income model was up 3.9% for the quarter and down 7.6% for the year but outperformed the Bloomberg Barclays U.S. Aggregate Bond Index which was up 1.9% for the quarter and down 13% for the year. As mentioned previously it was a very difficult year for fixed income due to rising interest rates. Long-term Treasury bonds were down 29% percent for the year. The Federal Reserve is still indicating that they will stay the course to bring inflation down. Whether these actions will lead to an upcoming recession remains to be seen and is a matter of great debate. The reason for our outperformance in the fixed income area is due to our overweighting short-term fixed income and underweighting our exposure to longer-term bonds. Our bond exposure is still overweighted in short term securities for now while the Fed is engaged in a cycle of raising interest rates. However, as the Fed nears the end of interest rate hiking cycle, we are looking to make an allocation shift in the upcoming months.

Within our equity and growth strategies, the Liquidity Factor Strategy was up 14.2% for the quarter and -15.1% for the year. It was the top performing segment in a tough year. This strategy uses a proprietary method to take advantage of pricing anomalies in stocks that are less liquid and relatively ignored by the market. The strategy is comprised of ten holdings that see little turnover and was virtually unchanged for most of the year. This strategy struggled during the first half of the year but clawed back some of its losses in the in third and especially fourth quarters. There was no turnover of its holdings during last quarter as well. The primary exposures still remain in the Consumer Cyclical and Healthcare sectors. The Relative Strength ETF Strategy was up about 5.4% for the quarter and is still allocated to Small Caps and Treasury Bills.

Fundamental 20 was up 10.7% for the quarter and was down 15.8% for the year. This strategy focuses on highly profitable companies that have excellent value compared to their cash flows and/or net income. We look for companies that are using their capital efficiently to make money. We added six new names were to the strategy in January: BOK Financial (Regional Banks), Cardinal Health (Medical Distribution), CF Industries Holdings (Agricultural Inputs), Dropbox (Infrastructure Software), O’Reilly Automotive (Specialty Retail), PDC Energy (Oil & Gas Exploration & Production).

The Fast Movers strategy continued to have a difficult year in conjunction with breakdown in technology and growth stocks. It was up 4.7% last quarter but was down 30.7% for the year. This is our most aggressive strategy that actively seeks high growth and as a consequence can experience regular large drawdowns. Throughout the year the strategy rotated out of a more aggressive technology stocks and into more healthcare (particularly Biotech), and some consumer defensive names. The strategy now holds four technology, five healthcare, four consumer cyclical and one industrial, consumer defensive and communication service. We added positions in Ross Stores (Retail Apparel) and Amazon (Internet Retail in January.

The Top Flight Model Portfolio was up 9.1% for the quarter and down 19% for the year. By way of comparison, this was better than the NASDAQ (-33.1%), slightly better than Small Caps (-20.4%), slightly behind the S&P 500 (-18.1%) and lagging the Dow Jones Industrials (-8.8%). Top Flight continues to be comprised of 25% Fast Movers, 40% Fundamental 20, 20% Liquidity Factor, and 15% ETF RS. Among our overall equity holdings, the top five performers for the first quarter were Moderna, Gilead Sciences, United States Steel, Mettler-Toledo International, and Pinduoduo. The worst performers were among our most aggressive holdings such as Tesla, Atlassian Corp, Enphase Energy, Palo Alto Networks, and Biogen.