Settling Down

September is typically tough. The market finally gave in to the bad news that had been stalking it all year: inflation. This is, of course, thanks to COVID-19, continuing global supply chain disruptions, rising energy prices, stalled fiscal and infrastructure bills, Chinese debt fears, and a pending Fed taper. The equity markets hadn’t experienced even a 5% pullback since last October.

Does this mean the bull market is over? Not yet, as historically you get about three 5% pullbacks per year. While the aforementioned risks are real, there are numerous risk factors haunting the market at any given time. Markets like to climb the proverbial wall of worry. As a skeptic, I follow all the “macro” factors (e.g., economic indicators, interest rates, liquidity, valuations) and what effects they could have on the investing landscape. However, we take what the market gives us in the present rather than trying to predict the future. Our investing strategies use various models designed to work in all market environments. We call it “diversifying by strategy.”

Financial risk is primarily associated with the possibility of losing money — and rightly so. Investing, however, is a long-term activity, and it can be riskier to be out than in. Unfortunately, our brains and emotions often work against us, and we make mistakes that hurt our long-term financial success. If you think you’re immune to this, you’re not human. Your best protection against risk is the amount you put at risk — it’s the only thing you can control. Your overall allocation is a crucial factor in your financial success.

Markets and the Economy

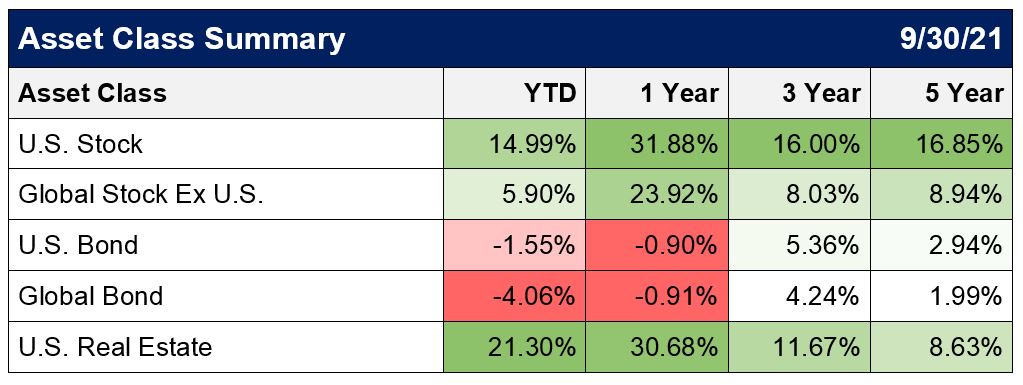

Most stocks and bonds were flat to slightly up for the third quarter. However, stocks are still up for the year while bonds remain down. The mega-cap growth names were the best performers, while small-cap growth and emerging markets were the worst. Energy is the best performing sector year to date, but only represents about 2.3% of the S&P 500. Other economically sensitive sectors that got crushed during the pandemic — such as financials and real estate — are having a great snap back year in 2021. The most defensive sectors, such as utilities and consumer staples, are the laggards year to date. As the economy opened back up, most of the value oriented and reflation names have caught up with the tech and communication stocks. These general upward moves across the market have pushed stock valuations to historically elevated levels. But nearly every asset is in the same boat. Real estate, bonds, cars, labor, etc. are now expensive. The economy jumped significantly due to the record fiscal stimulus put into effect, but as the economy settles back down to normal growth, it will turn into a fiscal drag. The Fed is set to gradually taper its bond purchases that have been pumping liquidity into the system. We are closely monitoring how the markets will react.

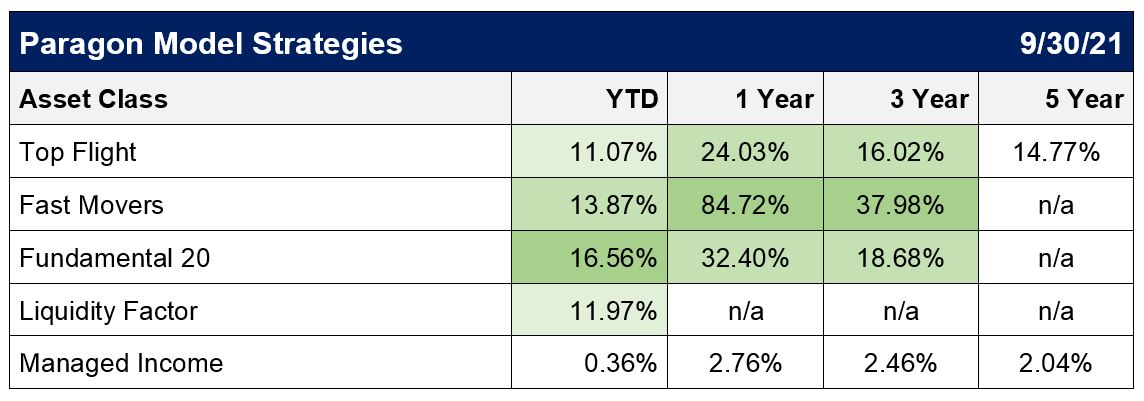

Model Portfolio Performance and Positioning

The Managed Income model was slightly down for the quarter and is now up 0.36% for the year. By comparison, the Bloomberg Barclays U.S. Aggregate Bond Index is down 1.5% year to date. The 10-year Treasury initially dropped sharply in July and then snapped back in September to just over 1.5%. Low yields continue to be a conundrum for the economy because it could be emblematic of low economic growth, but it also makes us extremely vulnerable to rising rates required to fight inflation. Our fixed income exposure remains flexible by continuing to use a laddered approach, and we currently have about 60% of our fixed income exposure in short-duration securities so that we can avoid large losses if interest rates move up. The primary objective of Managed Income is to preserve capital on an inflation-adjusted basis with a secondary objective of income. The portfolio is conservative by design and seeks to minimize risk. The returns will be constrained by the current low-interest-rate environment, but stretching for yield would entail taking on undue risk — and is not currently warranted.

Among our equity and growth strategies, Fast Movers, which had been lagging all year after a banner 2020, was the best performer last quarter up just over 6% (13.9% year to date). This strategy has been experiencing a rotation away from some of the best performers from last year’s pandemic economy. The strategy now holds mainly technology and healthcare names in the biotech and semi-conductor industries along with a few software, pharma, and internet names. The Fundamental 20 Strategy was up 0.56% for the quarter but remains the best performing strategy for the year up about 16.6%. In an unusual move for this strategy, nearly half the names turned over, taking on a markedly cheaper valuation attribute. We now own Interactive Brokers (capital markets), Interpublic Group (ad agency), Kohls (deptartment store), Louisiana-Pacific and Masco (bldg products & equipment), Organon (drug manufacturer), Oshkosh (farm & heavy construction machine), Whirlpool (appliances), and Williams-Sonoma (specialty retail). The Liquidity Factor Strategy also had a good quarter, up 3.7%, and is now up nearly 12% for the year. There were no changes to the holdings for this quarter and the primary exposures remain in the Consumer Cyclical and Healthcare sectors. The Relative Strength ETF Strategy lagged and was down for the quarter. Our Top Flight Model continues to be comprised of 25% Fast Movers, 40% Fundamental 20, 20% Liquidity Factor, and 15% ETF RS.

Among our overall holdings — Moderna, Dicks Sporting Goods, and Fortinet — were the top performers for the quarter. Foot Locker, Sage Therapeutics, and Qurate Retail were the laggards that aligned with the general underperformance of value-oriented names for the quarter.

*All Data in local currency and price only unless specified as total return (TR). Sources: MSCI, Barclays, Commodity Systems, Inc (CSI, YCharts), IDC, Ned Davis Research, Inc., S&P Dow Jones Indices. See Disclosures on page X for information on performance, risks, and benchmarks.