by Nathan White, Chief Investment Officer

The year’s first quarter was a great example of the importance of staying invested despite many valid risks and concerns. The headlines were definitely scary: Talk of imminent recession, lingering inflation, epic bank failures, and political contention (as if that’s anything new). Feel free to add any other worries to the list. So despite all the worries, stocks and bonds rallied and performed well for the first three months. The S&P 500 was up over 7%, and bonds, measured by the Bloomberg Aggregate, were up almost 3%. An excellent start to the year after a horrendous 2022.

Staying invested despite economic and political risks is important for several reasons, including:

- Long-term growth: Investing is a long-term game, and historically, the stock market has always rebounded from short-term market downturns. For example, during the 2008 financial crisis, the stock market dropped by nearly 50%, but it recovered within a few years, and those who stayed invested saw significant long-term growth.

- Diversification: Investing in a well-diversified portfolio can help mitigate risk, as different assets tend to perform differently in various economic and political conditions. By staying invested, you allow your portfolio to benefit from the potential upside of these diverse investments.

- Inflation protection: Inflation is a reality of the economy, eroding cash value over time. By staying invested, you can potentially earn higher returns that outpace inflation and protect your wealth over the long term.

- Missed opportunities: You risk missing out on potential gains by pulling out of investments due to short-term economic or political concerns. For example, if you had pulled out of the stock market during the COVID-19 pandemic, you would have missed out on the significant gains that occurred during the recovery period.

- Emotional decision-making: Economic and political events can be stressful, and fear and uncertainty can lead to emotional decision-making. However, making investment decisions based on emotion rather than logic can lead to poor choices and missed opportunities. By staying invested, you can maintain a long-term perspective and avoid making impulsive decisions.

Going forward, the risks remain and there is still an economic price to be paid to tame the inflation monster. We are in the crucial part of the game now where the economy is starting to feel the effects of the Fed’s monetary tightening (e.g., SVB and Signature bank failures). Can the economy hold up and avoid too much pain while inflation cools, or will the Fed cry uncle (as they did in backstopping bank deposits) before the job is done and reflate asset prices? We are not going to escape without economic pain. The only way to get prices to go down is for the economy to slow. Recession is still a very likely possibility. The timing and nature in which it unfolds is too hard to call. Be cautious and prudent with your finances and prepare as best you can. See my PAST article for advice on measures to take.

Model Portfolio Performance and Positioning

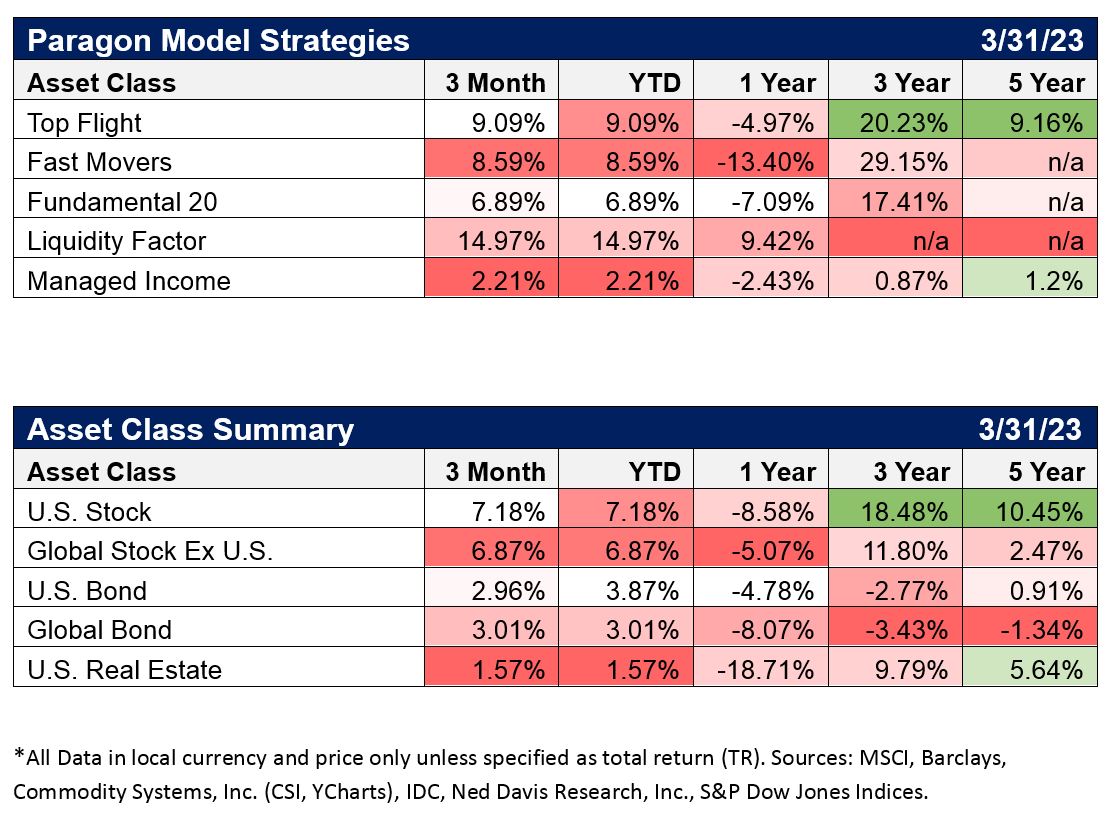

Most of our strategies outperformed relevant benchmarks to start the year. What did well in the first quarter of this year was the opposite of what did well last year. Growth stocks outperformed value, and technology was the best-performing sector by a wide margin. The energy sector which was the best performer in 2022, was the worst performer in the first quarter of 2023. The energy sector currently exhibits good values and cash flows, and our models added exposure as the sector declined. As I mentioned last quarter, if the economy heads into a recession, then we probably haven’t seen the lows in the market. For now, we will keep our normal positioning and let our allocations and rebalancing keep us in the game.

The Managed Income model was up 2.2% for the quarter, which was slightly behind the Bloomberg Barclays U.S. Aggregate Bond Index, which was up 2.96% for the quarter. Bonds have rallied on the expectation that the Federal Reserve is finished or nearly done with hiking interest rates. Many expect the Fed will lower rates in the latter half of the year. The reason for our slight underperformance in the fixed income area is due to our overweighting short-term fixed income and underweighting our exposure to longer-term bonds. Our bond exposure is still overweighted in short-term securities for protection and safety. These shorter-term securities yield more than the longer-dated maturities due to the yield curve inversion. We also need to see more of an attractive spread between safe securities and corporate and/or high-yield fixed income to make the latter a compelling opportunity.

Within our equity and growth strategies, the Liquidity Factor Strategy was up nearly 15% for the quarter. It is the top-performing segment for the year so far. This strategy uses a proprietary method to take advantage of pricing anomalies in stocks that are less liquid and relatively ignored by the market. The strategy comprises ten holdings that see little turnover and was virtually unchanged for most of the year. This strategy also happened to be the best-performing segment last year as well. There was no turnover of its holdings in the previous quarter, and only one holding change was made at the beginning of April. The primary exposures still remain in the Consumer Cyclical and Healthcare sectors. The Relative Strength ETF Strategy was up about 2% for the quarter and is still allocated to Small Caps and Treasury Bills.

Fundamental 20 was up 6.9% for the quarter. This strategy focuses on highly profitable companies with excellent value compared to their cash flows and/or net income. In addition, we look for companies that are using their capital efficiently to make money. We added six new names to the strategy in April: HF Sinclair (Oil & Gas Refining), Maravai LifeSciences (Biotechnology), Palo Alto Networks (Infrastructure Software), and UWM Holdings (Mortgage Finance).

The Fast Movers strategy was up 8.6% for the first quarter. This strategy is our most aggressive strategy that actively seeks high growth. As a consequence, it can experience regular large drawdowns. The strategy is now allocated to mostly consumer cyclical, technology, and Healthcare positions. The strategy currently holds four technology, four healthcare, five consumer cyclical, and one utility and communication service stocks. We added positions in Booking Holdings (Travel Services), Align Technology (Medical Devices), and ASML Holding (Semiconductor Equipment & Manufacturing) in April.

The Top Flight Model Portfolio was up 9.1% for the quarter, which, ironically enough, was the same amount as the last quarter of 2022. By way of comparison, this was better than the S&P 500 (7.5%), Small Caps (2.7%), and lagging the Dow Jones Industrials (0.40%) but behind the NASDAQ (16.8%). Top Flight continues to be comprised of 25% Fast Movers, 40% Fundamental 20, 20% Liquidity Factor, and 15% ETF RS. Among our overall equity holdings, the top five performers for the first quarter were NVIDIA, Tesla, MercadoLibre, Advance Micro Devices, and Palo Alto Networks. Conversely, the worst performers were mainly among our cyclical holdings, such as Antero Resources, Enphase Energy, BOK Financial, CF Industries, and Marathon Oil.