by Nathan White, CIO

The biggest question right now is if the economy will remain resilient in the face of high interest rates. We are caught in a debt trap and the inflationary response was a symptom of the underlying problem.

Imagine the economy as a well-functioning digestive system, with various economic agents, industries, and financial institutions playing roles similar to the organs and processes within the human body. Now, let’s use the analogy of the economy trying to digest a massive amount of debt:

The Economic Digestive System

- Economic Stomach: The economic stomach represents the financial system where debt is initially ingested. When the economy is healthy, it can easily digest a reasonable amount of debt, much like a stomach breaking down and processing a well-balanced meal.

- Debt as Food Intake: Debt, in this analogy, is comparable to food intake. It’s a necessary part of the economic diet, providing fuel for growth and development. However, just as too much unhealthy food can overwhelm the digestive system, excessive debt can strain the economic system.

- Digestive Organs: Various economic actors, including consumers, businesses, and governments, act as digestive organs. They process and distribute the “nutrients” derived from debt throughout the economic body.

- Enzymes: Financial institutions and central banks can be seen as enzymes that help break down and distribute debt. They play a crucial role in facilitating the flow of capital and managing the overall health of the economic digestive system.

The Challenge of Massive Debt

- Overeating (Excessive Debt): If the economy consumes too much debt, it’s akin to overeating. At first, the system may struggle to process the excess, leading to inefficiencies and imbalances.

- Indigestion (Financial Instability): The economic system may experience indigestion, analogous to financial instability. This can manifest as market volatility, credit crunches, and challenges in maintaining economic equilibrium.

- Overburdened Organs (Debt-Laden Sectors): Just as overeating can strain specific organs, excessive debt can burden particular sectors of the economy. Industries or households with high levels of debt may find it challenging to operate efficiently.

- Risk of Organ Failure (Default and Bankruptcies): In severe cases, excessive debt could lead to “organ failure” in the form of defaults and bankruptcies. Economic actors may struggle to meet their financial obligations, putting stress on the entire economic system.

The Remedies

- Balanced Diet (Sustainable Debt): To maintain a healthy economic digestive system, a balanced diet (sustainable debt levels) is crucial. This involves responsible borrowing and lending practices, ensuring that debt serves as a constructive source of energy rather than a burden.

- Exercise (Economic Growth): Regular exercise (economic growth) helps the economic body burn calories (reduce debt burden). By fostering growth, the economy can enhance its capacity to manage and service debt.

- Nutritional Guidance (Prudent Financial Policies): Sound nutritional guidance (prudent financial policies) from economic policymakers, analogous to dietary advice, helps ensure that the economy consumes the right type and amount of debt.

- Medical Check-ups (Financial Regulation): Periodic medical check-ups (financial regulation and stress tests) help identify potential issues early on, allowing for preventive measures to maintain the long-term health of the economic digestive system.

The economy and consumer must adjust to the massive amount of debt that has been issued and the higher cost of servicing it. Any attempt by the Fed to stop it will just prolong it and make it worse. The debt bills are starting to come due and will increase over the next few years. It could be painful for a while.

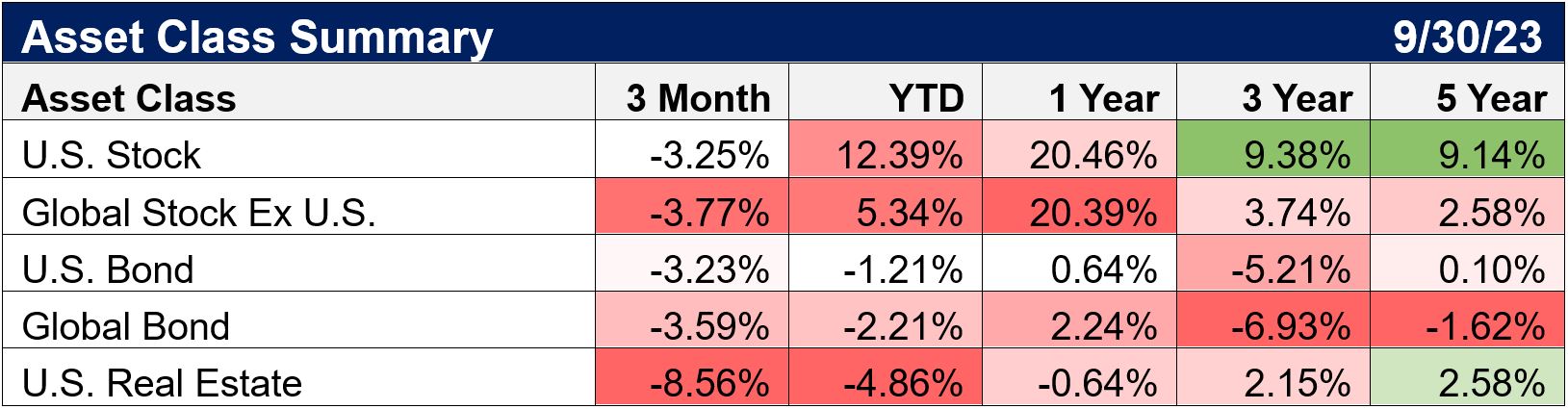

Even though this sounds bearish the best course of action for investors is to stay the course. I am very cautious and concerned about the economy, but the market always wants to knock you out of the game. However, the biggest risk is to be out of the game. Staying invested in with a balanced portfolio will help to even out the risks and take advantage of opportunities. One of my favorite mantras is to take what the market gives you. Right now, with interest rates rising the fixed income markets are creating an opportunity to realize higher future returns in a safe manner. Rising interest rates initially lead to a decline in the prices of existing bonds, as in seen in negative bond returns the last few years but they can create opportunities for higher, safer returns in the future.

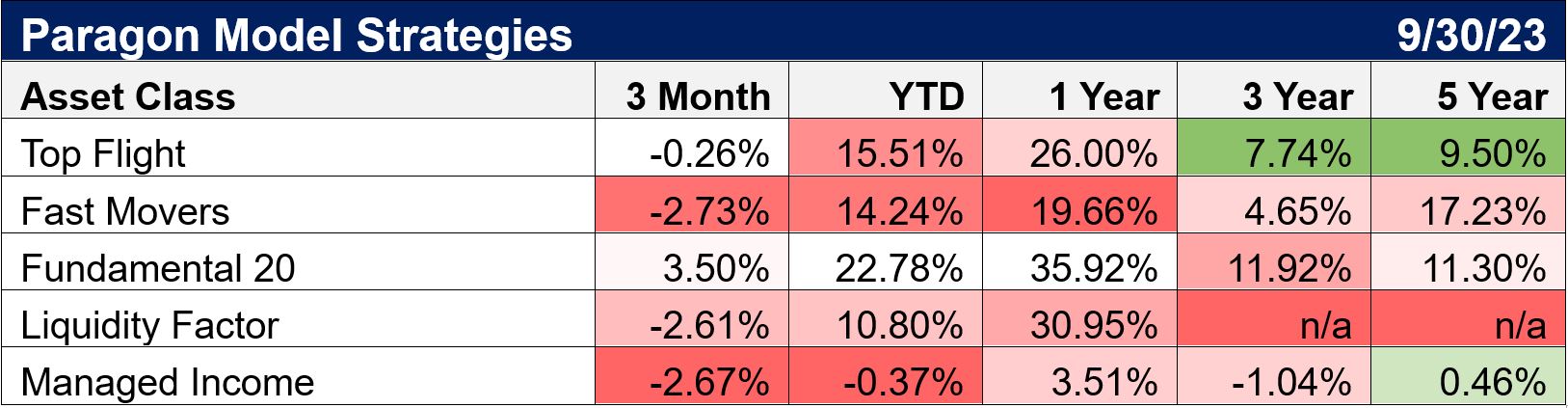

Model Portfolio Performance and Positioning

Most of our strategies outperformed relevant benchmarks for the year so far. Our overall fixed income and equity allocations have outperformed, and we have a meaningful amount of dry powder in the form of short-term Treasuries to protect against and take advantage of weakness should it continue.

The Managed Income model was down about 2.7% for the quarter which was slightly better the Bloomberg Barclays U.S. Aggregate Bond Index which was down 3.1% for the quarter. Interest rates continued to rise steadily in the quarter which sent bond prices down. The markets were expecting the opposite and were hoping that the Fed would say it is done with higher rates. Many expected the Fed to signal lower rates for next year, but the Fed did the opposite in its September meeting by telling everyone to expect higher rates for longer. As October began, the 10-yr Treasury was fast approaching 5%. Our bond exposure is still overweighted in short term securities for protection and safety. These shorter term securities are yielding more than the longer dated maturities due to the yield curve inversion. However, our long wait is getting closer to an end as yields on longer term maturities rise. As the interest rates rise further from here, we will be looking to add exposure to longer term bonds in a gradual manner. We are not yet seeing enough of an attractive spread between safe securities and corporate and/or high yield fixed income to make the latter a compelling opportunity. We remain primarily concentrated in government bonds. If a recession develops, we will have plenty of protection and flexibility to take advantage of better opportunities.

Within our equity and growth strategies, the Liquidity Factor Strategy was down 2.6% for the quarter and is up just shy of 11% for the year. This strategy uses a proprietary method to take advantage of pricing anomalies in stocks that are less liquid and relatively ignored by the market. The strategy is comprised of ten holdings that see little turnover and was virtually unchanged for most of the year. This strategy also happened to be the best performing segment last year as well. There was no turnover of its holdings during last quarter as well and only one holding change made at the beginning of April. The primary exposures still remain in the Consumer Cyclical and Healthcare sectors. The Relative Strength ETF Strategy was up down about 3% for the quarter and about 4.5% for the year as its Small Cap exposure struggled. We made a change within the strategy in October, and it is now allocated to Mega Caps and Treasury Bills.

Fundamental 20 was up 3.5% for the quarter and is up nearly 23% for the year. It is the top performing segment for the year so far. This strategy focuses on highly profitable companies that have excellent value compared to their cash flows and/or net income. We look for companies that are using their capital efficiently to make money. We added five new names to the strategy in October: Cava Group (Restaurants), Euronet Worldwide (Infrastructure Software), Gap Inc (Retail Apparel), and Lennar and Toll Brothers (Residential Construction).

The Fast Movers strategy was down 2.7% for the third quarter and is up just over 14% for the year. This is our most aggressive strategy that actively seeks high growth and as a consequence can experience regular large drawdowns. The strategy is now allocated to mostly to technology and communication services positions. The strategy now holds eight technology, two communication services, and one position each in healthcare, consumer cyclical and utilities. We added positions in Tesla (Auto Manufacturers), Constellation Energy (Renewable Energy) and Zscaler (Infrastructure Software) in October.

The Top Flight Model Portfolio was down 0.26% for the quarter and is up 15.5% for the year. By way of comparison for third quarter, this was better than the S&P 500 (-3.3%), Small Caps (-4.1%), and the Dow Jones Industrials (-2.6%) but behind the NASDAQ (+12.8%). Top Flight continues to be comprised of 25% Fast Movers, 40% Fundamental 20, 20% Liquidity Factor, and 15% ETF RS. Among our overall equity holdings, the top five performers for the third quarter were PDD Holdings, HF Sinclair, Marathon Petroleum, CF Industries, and Valero Energy. The worst performers were mostly among the more growth focused holdings such as Fortinet, Datadog, Maravai Lifesciences, Mettler-Toledo and Align Technology.

*All Data in local currency and price only unless specified as total return (TR). Sources: MSCI, Barclays, Commodity Systems, Inc (CSI, YCharts), IDC, Ned Davis Research, Inc., S&P Dow Jones Indices. See Disclosures on page X for information on performance, risks, and benchmarks.