by Nathan White, Chief Investment Officer

Are you ready? The bear has been ravaging the markets and the price action is a warning for what’s coming to “Main Street.” Bear markets are always difficult to endure because of their depth and duration. They take time, and they are almost always associated with recessions. I don’t know the magnitude of the economic slowdown, but it’s coming. I know this sounds gloomy, so let me pivot and explain how recessions are actually a good thing.

Recessions are a normal and necessary part of the economic cycle. They remove the excesses built up during economic boom times and reset the system for a new leg of expansion. In the absence of recessions, excesses accumulate until something snaps. Over the decades, the Federal Reserve has increasingly intervened in markets and the economy in attempts to smooth out the business cycles. In the aftermath of the 2008-2009 financial crisis, the Fed intervened numerous times and kept rates artificially low. This allowed otherwise weak companies to stay in business by taking on cheap debt, and it forced investors to seek out risky investments since safe alternatives provided no return. Capital flew to unproductive uses (Crypto anyone?). Low interest rates enabled consumers to take on debt to expand consumption. And since the economic system has not been allowed to reset for decades, debt has increased to the point that hampers the growth of the economy.

A reset allows for robust future economic growth and returns. While the reset is painful, it can set the stage for a better tomorrow. Disciplined long-term thinking can help you avoid the emotions that come with bear markets and the hazards of selling low. Over the long-term, it is always more dangerous to be out of the market than in. Historical data shows that, on average, stocks return 16% one year after the start of a recession (Source: Ycharts, National Bureau of Economic Research, 04/01/22).

TAX BENEFIT

During this market drawdown we have been active in tax loss harvesting. This is one of the advantages to our more active style of investing. Tax loss harvesting can be of significant value to taxable accounts in that the realized losses can offset future gains and provide a possible tax deduction. When your capital losses exceed your capital gains, you can use up to $3,000 to reduce your income. Any unused capital loss can be rolled over to future years. The realized losses must always be used first to offset any capital gains. Tax loss harvesting is extremely valuable and must be done in the correct manner. When selling stocks at a loss, it is crucial to reinvest the proceeds and not just leave the funds uninvested. You need to retain exposure to the markets to benefit from any subsequent rise in prices. You don’t want to sell low and lock in the loss, depriving yourself of future growth.

MODEL PORTFOLIO PERFORMANCE AND POSITIONING

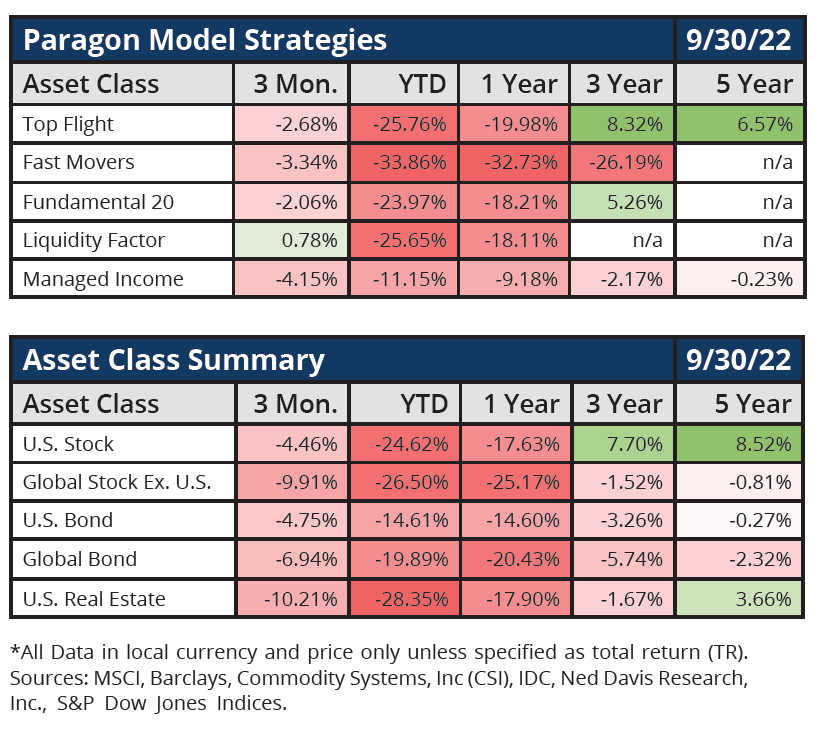

All of our strategies outperformed the most relevant benchmarks for the quarter. See accompanying table below.

The Managed Income model was down 4.2% for the quarter and down 11.2% for the year, but outperformed the Bloomberg Barclays U.S. Aggregate Bond Index, which was down nearly 4.8% and is now down 14.6% for the year. It has been a difficult year for fixed income due to rising interest rates. The Federal Reserve has been adamant they will do whatever it takes to bring down inflation. The worry, of course, is they will break the economy in the process. Long-term Treasury bonds are down nearly 29% percent for the year. To minimize the negative effects of inflation and rising interest rates, we reduced our exposure to longer-term bonds. These bonds contain too much risk for the meager return offered by their low yields. Our bond exposure is still overweighted in short-term securities, while the Fed is engaged in a cycle of raising interest rates. These short-term fixed income securities do not get hit with losses as longer-term bonds do when interest rates rise. They also offer increasingly higher yields as the rates climb. The Fed has now moved up its timetable for ending QE and raising interest rates. Our fixed income exposure remains flexible using a laddered approach to minimize the negative price impact of rising interest rates. We continue to have about 60% of our fixed income exposure in short-duration securities so that we can avoid large losses if interest rates continue to move up. The silver lining with rising interest rates is that our short-term fixed income positioning allows us to switch over to higher longer term rates, which can increase future returns. It’s as simple as the difference between buying a 1% bond versus a 4% bond. Which would you rather own? We have been waiting for a long time to get higher rates. We are now seeing this come to fruition, along with the unfolding of other interesting opportunities.

Within our equity and growth strategies, the Liquidity Factor Strategy was up 0.78% for the quarter and the top performer in a tough environment. This strategy uses a proprietary method to take advantage of pricing anomalies in stocks that are less liquid and relatively ignored by the market. It is comprised of 10 holdings that see little turnover. It struggled during the first half of the year but clawed back some of its losses in the third quarter. There was no turnover of its holdings during last quarter as well. The primary exposures still remain in the Consumer Cyclical and Healthcare sectors. The Relative Strength ETF Strategy was down around 7.8% for the quarter and is now allocated to Small Caps and Treasury Bills.

Fundamental 20 was down 2% for the quarter and is down 24% for the year. This strategy focuses on highly profitable companies that have excellent value compared to their cash flows and/or net income. We look for companies using their capital efficiently to make money. We added eight new names to the strategy in October: Antero Resources (Oil & Gas E&P), Builders FirstSource (Building Products and Equipment), Fortinet (Infrastructure Software), McKesson Corp (Medical Distribution), Marathon Oil (Oil & Gas E&P), Olin Corp (Specialty Chemicals), Raymond James Financial (Capital Markets) and Zillow Group (Internet Content and information).

The Fast Movers strategy has had a difficult year in conjunction with breakdown in technology and growth stocks. It was down 3.3% last quarter and is down over 33% for the year. It is an aggressive strategy that seeks high growth but has regular large drawdowns. The strategy has rotated out of a more aggressive position with technology stocks and into more healthcare (particularly Biotech), utilities and consumer defensive names. The strategy now holds four technology, five healthcare, three utility, two consumer cyclical and defensive position each, and one industrial name. We added positions in Pinduoduo (Internet Retail), Monster Beverage (Beverages) and Gilead Sciences (Drug Manufacturers) in October.

The Top Flight Model Portfolio was down 2.7% for the quarter and 25.8% for the year. By way of comparison, this was better than the NASDAQ (-32.4%), about the same as Small Caps (-25.1%), slightly behind the S&P 500 (-23.9%) and lagging the Dow Jones Industrials (-21%). Top Flight continues to be comprised of 25% Fast Movers, 40% Fundamental 20, 20% Liquidity Factor, and 15% ETF RS. Among our overall equity holdings, the top five performers for the first quarter were Mercadolibre, Constellation Energy Corp, Tesla, Ubiquiti, and Molina Healthcare. The worst performers were Quidelortho, Seagen, HP Inc, JetBlue Airways, and NVIDIA Corp.